In today’s article, we weigh in on the 2022 public sector wage negotiations, to see how the proposal put forward may affect our readers in that sector financially.

This article is an 8 min read.

In today’s article, we weigh in on the 2022 public sector wage negotiations, to see how the proposal put forward may affect our readers in that sector financially.

This article is an 8 min read.

Wage negotiations are an expected and necessary part of the employment experience. For some, it’s a conversation privately and individually held with their employers, while others rely on Trade and Labour Unions to publicly lobby on behalf of themselves and others in their sector/bargaining group. Wage negotiations require a meeting of the minds as both parties undertake to obtain better wages for employees in line with the current standard of living whilst ensuring that the increases offered are sustainable and viable in the long-term.

In the context of the currently unfolding public sector employees wage negotiations, Prime Minister Dr. Keith Rowley has indicated that they wish to prevent any job losses which surely makes these negotiations all the more difficult.

On May 19th 2022, President of the P.S.A., Leroy Baptiste, published a letter outlining the Chief Personnel Officer’s Proposal to the following Associations/Unions:

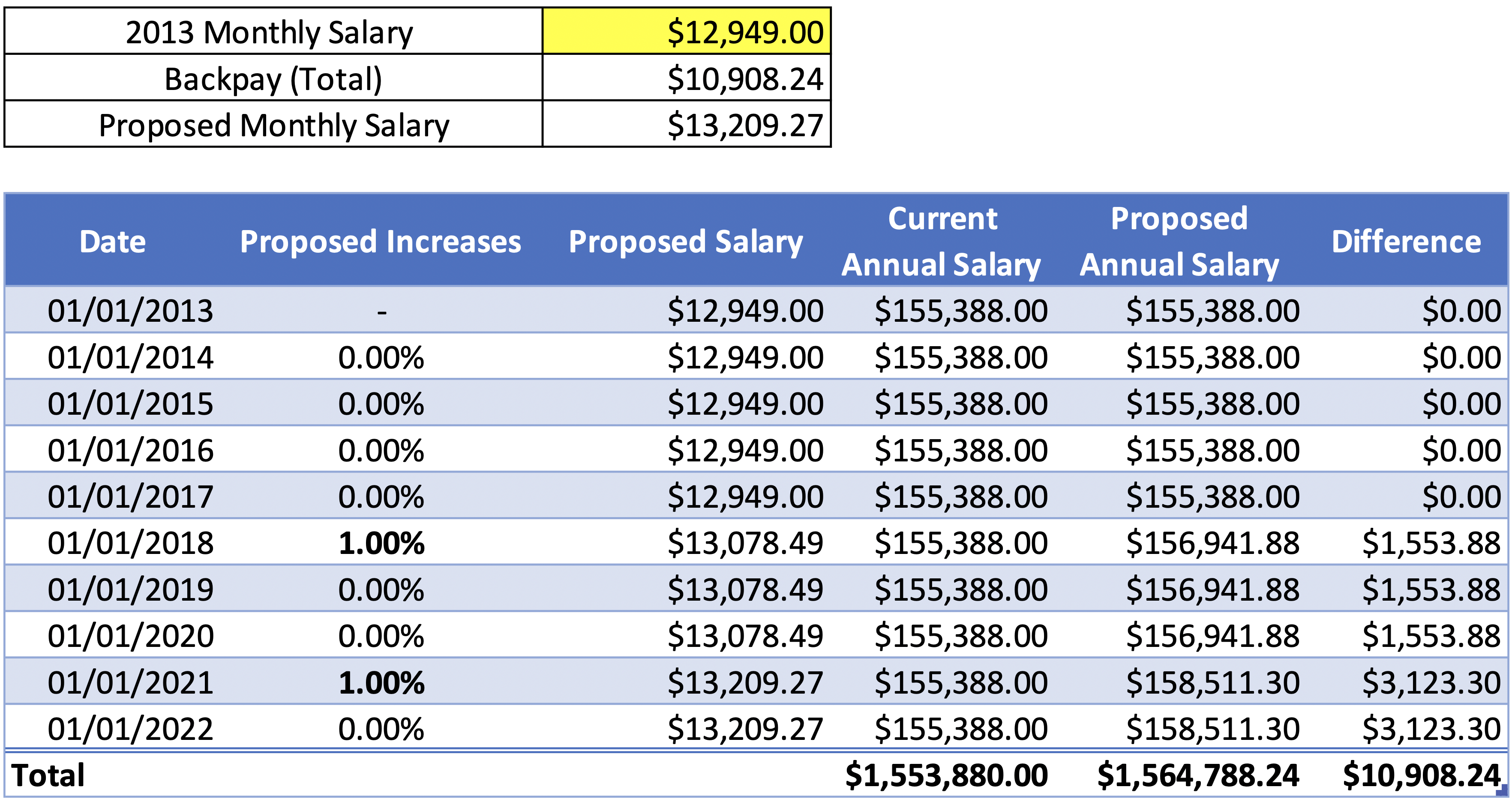

Salaries for the period January 1st 2014 to December 31st 2018 shall be revised as follows:

• With Effect from January 1st 2014 – 0%

• With Effect from January 1st 2015 – 0%

• With Effect from January 1st 2016 – 0%

• With Effect from January 1st 2017 – 0%

• With Effect from January 1st 2018 – 1%

Salaries for the period January 1st 2019 to December 31st 2021 shall be revised as follows:

• With Effect from January 1st 2019 – 0%

• With Effect from January 1st 2020 – 0%

• With Effect from January 1st 2021 – 1%

Cost of Living Allowance

• With Effect from January 1st 2020 – $240 per Month

• With Effect from January 1st 2021 – $255 per Month

In order to discuss and determine the associated impact of these changes on the average salary in dollars and cents, the following are some of the assumptions made:

Based on the CPO’s offer, the effective increase over the eight-year negotiation period will be 2.01%. This means that every $100 of salary income based on 2013 levels will now be $102.01 in 2021. This results in a 0.01%compounding effect – as the 1% increase in 2021 is applied to the 2018 salary level which will already be increased by 1% (i.e. 1% on 1%). The projected backpay will be $7.02 for every $100 dollar of salary a person earned based on their December 31st 2013 salary.

Consider this counteroffer:

Unsurprisingly, there is no net change to the 2.01% increase to employees’ 2021 level of income. However, the projected backpay now increases to $13.04 for every $100 dollar of salary a person earned based on their December 31st 2013 salary. This represents an increase of 185.75% to the backpay for which employees will be eligible. This counterproposal, therefore will not have a long-term impact on the government’s wage bill but rather will require an immediate one-time payout.

So what does this mean for someone employed in the public sector? How much backpay should they expect? What would be the dollar increase to their salaries when the increase is processed?

If the CPO were to adjust the offer to make the increases in the beginning year of each negotiating period the new salary figure will be the same whereas the back pay figure will increase to $20,262.60

This compounding effect is a great example of the Time Value of Money (TVM). TVM’s concept is that a sum of money is worth more now, than the same sum will be at a future date due to its earnings potential in the interim. From the example above, we see that the earlier the salary increases are implemented, the higher the amount earned each year and now due as backpay. Similarly, the earlier such funds are invested, the higher the possible return on investment as this same TVM concept has a longer time-period over which to work.

At Firstline, we are experts at creating, growing, and maintaining wealth in Trinidad and Tobago.

With some of our staff working for over 4 decades in the financial industry, they have witnessed many a person’s finances rise and fall, and there are specific actions taken by those who keep their finances rising over their life, compared to those who tragically fall.

Enter you email below to gain access to our masterclass video that outlines what it truly takes to transform your current savings into true wealth in Trinidad and Tobago.

This concept is one you should take heed of when planning your own wage negotiations, when saving up for the deposit on a real estate purchase, when you’re planning out the manner in which a debt is paid, or if you are expecting lumpsum payments. Truly capitalizing on the earnings potential of your money within a set timeframe is where wealth is made – and if you look closely, you will see many opportunities for you to really flex the earning potential of the money you have at hand. Many a potential nest egg has squandered its earnings potential by sitting in a standard savings account for years. With the help of your trusted financial advisor, look analytically at your current finances and look for ways in which you can get your money living up to its full earnings potential.

Unexpected cash flows like backpay can surely go a long way in covering some unanticipated expenses, paying for a small vacation with family, or something even more crucial: investing towards the achievement of other personal short to long term goals.

Like the key stakeholders in this matter, we all wait to hear the PSA’s response to the CPO’s offer and the long term impact on these public sector employees’ salaries, the government’s wage bill and the economic sustainability of whatever decision is made. Until then, keep reading our articles for more strategies to assist you in flexing the earnings potential of your income and continue growing your wealth.

We are Firstline Securities Limited, an independent financial services firm, based in Trinidad and Tobago.

We are experts in creating, growing, and retaining wealth for our clients in T&T, as well as in the French, Dutch, and OECS territories of the Caribbean.

We invite you to look around our website for more information. If you’d like to begin the process of becoming a client, simply click the button below.

1 Comment

Ok so what about the public servants who work for 2400.00 a month what cat you do with that come on before making an example try doing it on the ones that make little to no kind of money please