Many global shifts are occurring around us in the Caribbean. As your friendly financial advisors, we like to keep you abreast of major movements that can potentially affect future investments and strategies.

We believe that the article above is an important one for investors to note, however we first need to differentiate between the decline of the importance of the U.S. dollar (US$) and the decline of the United States of America as a powerhouse in terms of the economics and % of GDP of the world.

Firstly, there is a link between the 2 of them.

There have been rumours of the decline of the United States as an economic power for maybe 100 years, but that economy has dumbfounded all the naysayers and continued to be resilient.

The truth is, time is something that we don’t have a definitive definition for; what is an appropriate time? How long did the British Empire take to decline? How long did the Aksum empire take to decline? How long did the Roman empire take to decline? What about the Han Dynasty? The Turkish Empire? The Egyptian Empire? And many other empires before it. Is it 100 years? 200? 300? While we don’t have a definitive answer, the decline is probably a gradual thing as opposed to a sudden cliff drop.

Currently, there are a number of fundamental signs that are taking place within the US economy that point to a gradual decline.

One sign is its persistent deficit and the fact that they have racked up debt above 100% of their GDP. Now, that has also been the case with the Japanese – where their debt to GDP had been over 100% for a very long time. The US economy may be going in that direction, and it is possible that like the Japanese economy they may say, “listen, it’s our own people we owe this debt to, so it’s not that big a deal.” However, we know that a lot of the US debt is held by other countries around the world such as Japan and China, with many holding the US as a reserve currency.

When we think of the physical factors and negative balance of trade, the reduction in the volume of trade being conducted in US$ will have a material impact on the value of the US$. Oil represents a major part of global trade and that is generally denominated in US$, but to the extent that major economies in the world cease trading in US for oil and oil derivatives, it would reduce the importance and the need for US$ both as a medium of exchange and a store of value. You may well find that if many people no longer earn a revenue in US$, they won’t feel a need to invest in the US economy. They then don’t need to buy US treasuries or other US securities which would cause the value of the US$ to decline over time.

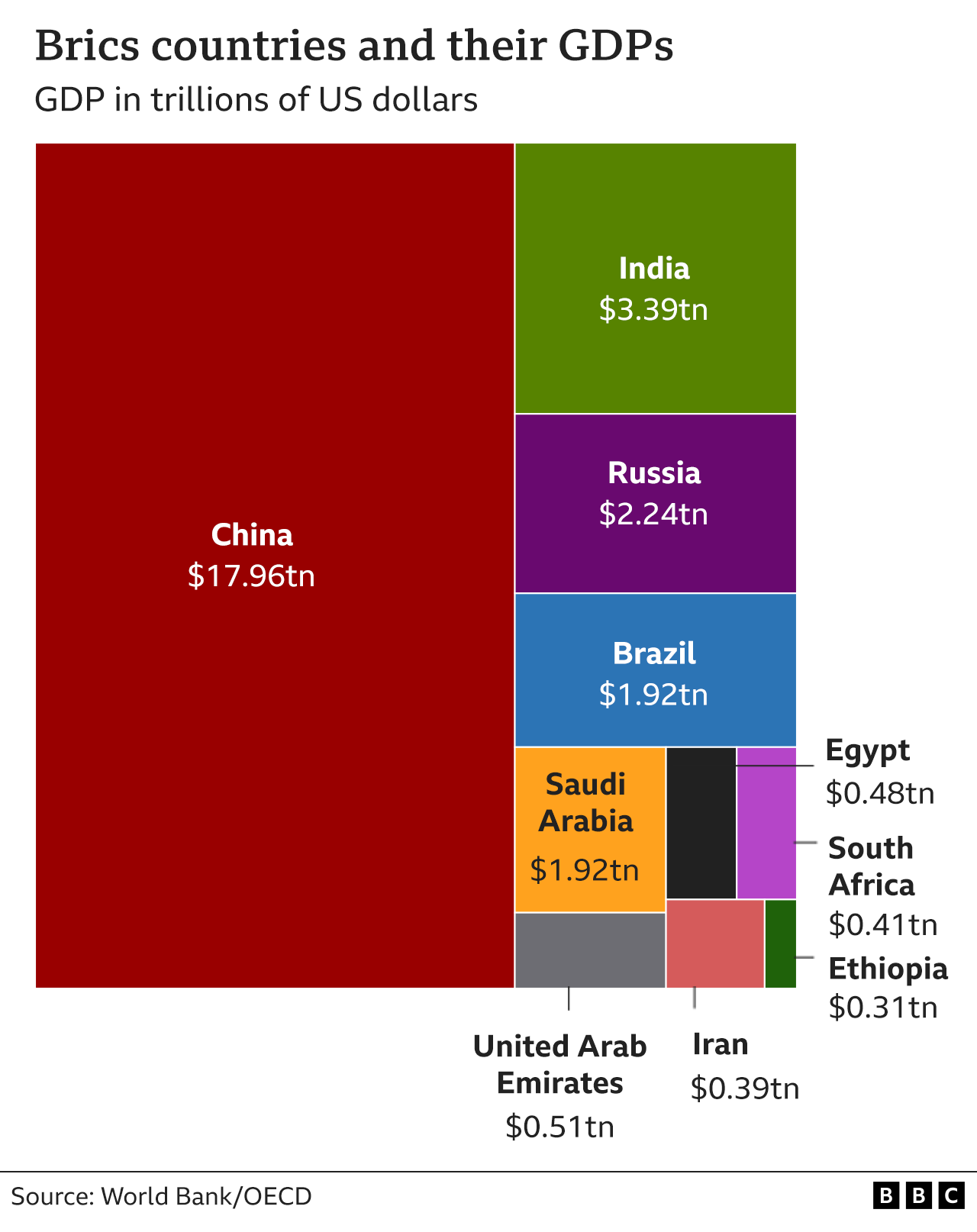

This is the major problem that is being signalled with BRICS, and the potential BRICS currency – the reduction in the use of the US$ both as a medium of exchange and a store of value, and as a consequence, BRICS becomes both a physical and psychological barrier to maintaining the value of the US$. That is why our investors need to be aware of this development from BRICS, as it would mean that whatever store of value they have in the US dollar may likely decline over time. While we don’t think it would fall off a cliff, whatever holdings one may have in US $ may decline in the future due to perceptual and political movements, like the seizure of $300 billion in reserves of the Russian Central Bank by the West. Events such as these signal to many countries that it is not safe to hold US$ in reserve because their savings could be seized by FIAT, and therefore the demand for holding savings in US$ may go away.

Caribbean investors can consider selectively investing in securities from BRICS+ countries. Due to the paucity of credible information to evaluate investments and our absence on the ground, one can use ETFs or other on the ground experts to make such choices. There are many multinational companies that operate in BRICS+ countries and give exposure to those markets (eg META, Microsoft, Apple), however care must be exercised when making financial decisions.

As always, please seek specific financial advice for your situation. If you’d like to get our personalised advice on ways to protect your wealth from the range of global happenings, don’t hesitate to contact us.

We remain your friendly financial advisors,

Team Firstline