In the Caribbean specifically, much of the opportunity to investors will be driven (or limited) by the policy of governments. There is an opportunity for governmental corporations to source climate financing to develop infrastructure such as renewable energy plants. In a region of islands, with several volcanoes, we can develop tidal, solar, wind or geothermal renewable energy facilities based on a cost benefit assessment.

In 2017 Barbados benefited from the UAEs Joint Implementation US $50 million Caribbean Renewable Energy Fund as funded and commissioned a 420-kW solar photovoltaic farm. The solar farm gave Barbados a fuel cost reduction of BDS$10 million annually, has a total generation capacity of 10MW, can power 7,700 homes, and reduces CO2 by 21,000 tonnes annually.

The fund has identified at least four other countries inclusive of Barbados to fund additional projects. The commitment of over US$100 billion in the ‘’Glasgow Climate Pact” opens significant similar opportunities for the Caribbean. To capitalize on them, Governments in the region need to develop and enact policies which position themselves and industries to benefit from investment into carbon capture infrastructure. They can create “green” business zones and provide incentives for companies seeking to use carbon capture technologies to produce fertilizer, plastics and building materials and carbon methane.

An already net-zero nation, Suriname, signed an agreement in 2021[16] with oil company TotalEnergies, under which the company will pay US$50 million in return for carbon credits, as part of the Emissions Trading program.

Guyana is another Caribbean nation in transition due to 85% of its land area covered by tropical rainforest in conjunction with the multiple investments in their growing oil and gas sector. They have currently developed a Low Carbon Development Strategy to begin integrating Guyana’s forest and climate services with emerging global carbon markets.

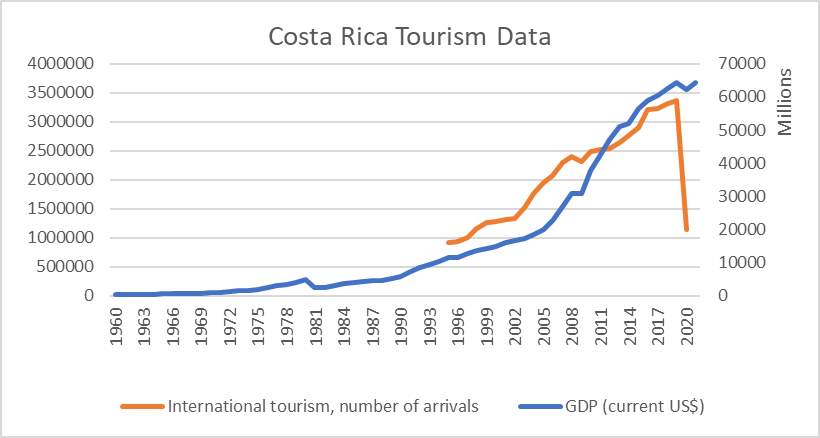

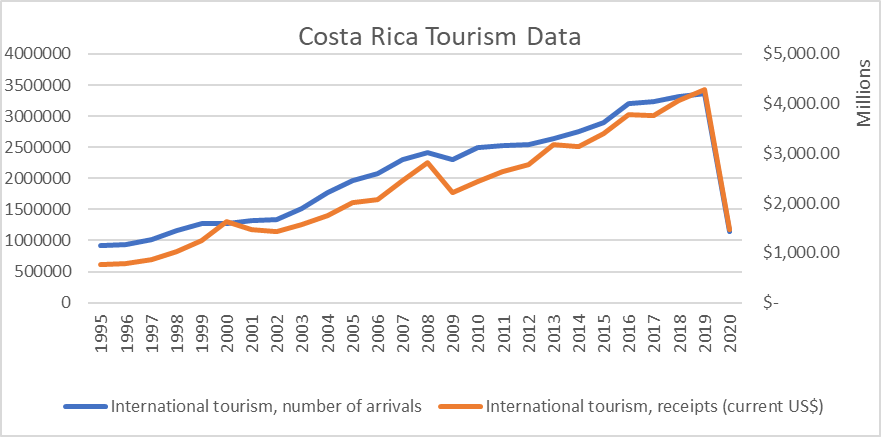

Then there is the option to further develop the Caribbean’s main industry, tourism. However, if climate change continues unabated tourism wouldn’t be our primary concern, the effects of Dorian on Bahamas in 2019 is a clear reminder of this. Ecotourism projects structured around the regions tropical forest, wildlife, coral reefs and unique land formations will not only provide a variation to the sun sea and sand options currently provided; it will bring visitors from developed countries face to face with what they can lose because of climate change. By enhancing the Caribbean product to show case what is most at risk from climate change the region can appeal to a different side of human behaviour. Also forest and reefs are highly effective tools of “natural” carbon capture. Costa Rica has led the region in eco-tourism for almost three decades and has seen visitor numbers grow from three hundred thousand people in the late 1980’s to over 3 million people by 2019 bringing in over US $2 billion in revenue annually.

[16] “TotalEnergies Partners With The Government of Suriname To Contribute To Preserve Forests As Carbon Sinks”: https://totalenergies.com/media/news/press-releases/TotalEnergies-Contributes-to-Preserve-Suriname-s-Forests