INSIGHTS

Ever Thought About Why Some People Are Wealthy…And Others Are Not?

Often enough we hear that it is not how much money you have but what you do with it that makes the difference between whether you will accumulate wealth or not. This is very true.

The wealthy do very different things with their money than people who are not wealthy. If you refer to the book ‘Rich Dad Poor Dad’ or a short video clip by Tim Sales you will see this explained albeit in their own style.

As a matter of fact, the wealthy, the middle class and the poor all tend to do very different things with their money which to a large extent determines their economic wellbeing or conversely their financial ill health.

Often enough we hear that it is not how much money you have but what you do with it that makes the difference between whether you will accumulate wealth or not. This is very true.

The wealthy do very different things with their money than people who are not wealthy. If you refer to the book ‘Rich Dad Poor Dad’ or a short video clip by Tim Sales you will see this explained albeit in their own style.

As a matter of fact, the wealthy, the middle class and the poor all tend to do very different things with their money which to a large extent determines their economic wellbeing or conversely their financial ill health.

The following describes what the three different groups tend to do with their incomes and why the wealthy become wealthier, the poor get poorer and the middle class continue to struggle. Creating wealth is not magic. It is a simple formula anyone can follow once they have been educated to do so, or they can use the services of those who know how to create wealth for them.

Before we begin let us first define a few terms for clarity.

Income– This is the money you earn.

Expenses– Simply what you spend.

Assets– Something you own that either pays you through capital appreciation or a stream of income or both.

Liabilities– Anything that costs you money without generating any financial returns.

Habits of the Poor

People who are poor understandably must spend a lot of their income on necessary recurrent expenditure like food, clothing and utilities. After covering this however they tend to buy unnecessary consumer durables that adorn their houses, apartments and motor vehicles. The thing about these unnecessary purchases is that they quickly depreciate and by extension reduce their wealth. Additionally, the very act of buying unnecessary things transfers wealth to the wealthy. What further compounds this is that very often the poor take loans and pay a lot of interest to acquire some of these items. In doing so they are spending future income to consume items today that create no wealth for them in the future.

Christmas is a prime example of this excess spending where potential wealth is transferred from the poor to the rich.

Habits of the Middle Class

The middle class are persons who are generally well-educated or skilled and would normally earn a very good income. These are the professionals who work long hours selling their skills to one employer or another until retirement. Their habits however are similar to the poor except on steroids. They often have very good disposable income and that is exactly what they tend to do with it. They buy very expensive toys, go on regular trips abroad, change their cars regularly, have huge loans and fancy sounding credit cards. This group tends to enjoy the best that their current income can afford without much consideration for wealth creation. They are quite prepared to live off their company’s pension and a little savings after retirement which is usually a fraction of their income, and it will eventually get eaten up by inflation. Many go back to work after retirement to subsidise their pensions or meet needs that should have been catered for during their prime earning years.

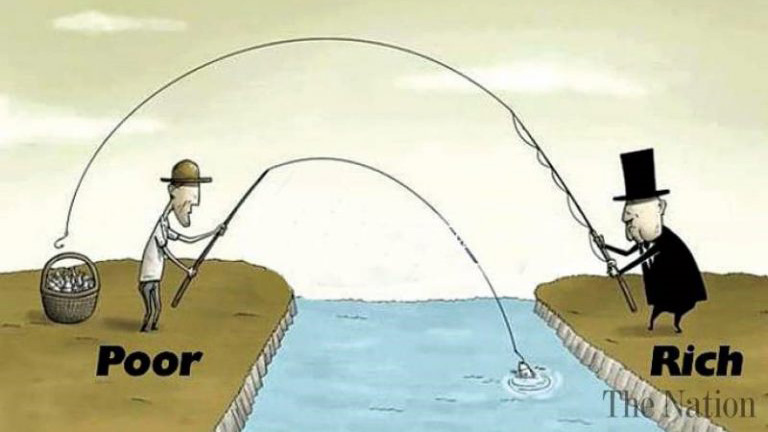

Income for the middle class and the poor are dependent on their own efforts and their spending habits are the major donors or contributors to the wealthy.

Habits of the Wealthy

Wealthy people or people who become wealthy do not spend most of their disposable income on consumer durables. Instead they put aside their excess income every month to invest in assets. These assets appreciate in value and/or generate additional income which is then reinvested again and again. They hold the belief that you should aim to have your money work for you and not the other way around. They invest directly in businesses, be it passive or active; they buy stocks, bonds and other investment instruments such as Loan Notes and Mutual Funds. If they do not have the knowledge, they then place their funds with experienced wealth managers and watch their money grow. Most of the wealthy people in the world today started off exactly like this.

If you are interested in generating wealth for yourself and your loved ones, do not hesitate to contact us at Firstline Securities Limited (info@firstlinesecurities.com; 1 868 628 – 1175/1554) and we will be more than happy to show you how we can make this happen for you!