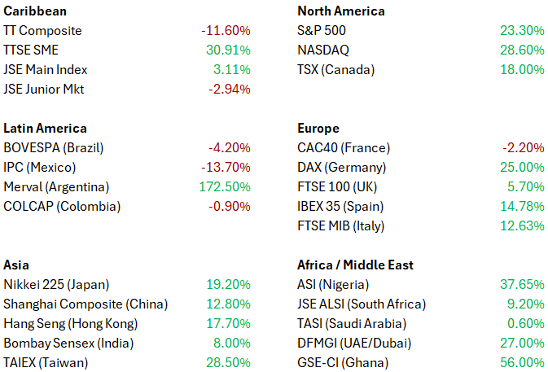

The U.S. equity market has dominated headlines, particularly due to the strong performance of the S&P 500 and NASDAQ. Advances in AI adoption and large-scale infrastructure investments in power and data centres have fueled these gains. However, several other global markets delivered noteworthy performances, presenting exciting opportunities for investors.

Closer to home, the TTSE SME Index led the region, driven by Endeavor Holding Ltd’s impressive +37.40% return and a solid performance from the year’s sole IPO, Eric Solis Marketing Ltd. Although the TT Composite Index declined in 2024, standout gains were recorded by ANSA McAL (+10.62%) and Prestige Holdings (+21.51%). Stock market underperformance was largely influenced by proposed regulatory changes for Collective Investment Schemes and Securities firms, limiting any entity’s holdings to 5% of a listed company’s traded shares. This triggered significant selling pressure, despite the strong fundamentals of many companies. Firstline sees this as a potential entry point for long-term investors seeking value opportunities.

In Latin America, Argentina’s equity market soared by a staggering +172.50%, buoyed by increased energy production and exports. The country also benefited from the initial effects of the President’s radical macroeconomic reforms, which reduced inflation from 211.4% in 2023 to 117.8% in 2024. In contrast, Mexico struggled with potential economic and political challenges linked to the incoming Trump administration, and Brazil faced political uncertainty tied to fiscal policy and budgeting.

In Asia, Taiwan outperformed its peers, benefiting from its critical role in the global chipmaking supply chain. Taiwan Semiconductor Manufacturing Company (TSMC) played a pivotal role, fabricating chips for NVIDIA and other AI hardware giants. Japan posted a 19% gain, spurred by a weaker yen that boosted exports and signs of economic revival after nearly three decades of stagnation. Meanwhile, China rebounded in 2024, supported by government stimulus initiatives that revitalised its real estate sector and strengthened investor confidence. However, the market will closely monitor how these growth policies evolve in 2025, particularly in the face of trade policy and tariff risks.

Europe saw strong performances from Germany (+25%), while Spain and Italy recorded gains in the low teens—marking a reversal from their historic underperformance over the past decade. The UK market, however, reflected uncertainty tied to the economic outlook for both corporations and the government. France faced mounting political and economic competitiveness concerns, resulting in minor equity market declines.

In Africa and the Middle East, standout performers included Ghana (+56.00%), Nigeria (+37.65%), and Dubai (+27.00%), where financial services and energy sectors drove growth.

For local investors with USD looking to capitalise on these international opportunities, Exchange Traded Funds (ETFs) trading on U.S. exchanges offer a simple and effective way to gain exposure. Firstline Account Executives and Portfolio Management representatives are available to provide tailored guidance and recommendations to help you navigate these exciting options.