Tesla, Inc. designs, develops, manufactures, sells and leases fully electric vehicles and energy generation and storage systems, and offer services related to its products, such as non-warranty after-sales services, sales of used vehicles, retail merchandise and vehicle insurance. It also has an energy generation and storage segment which deals with a range of solar energy related products and services. Tesla is popular for its Model 3, Model Y, Model S and Model X vehicles.[vii]

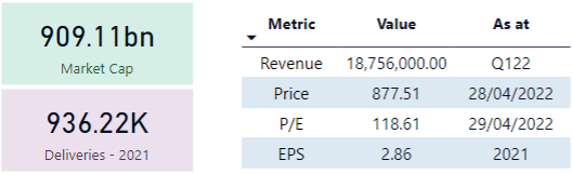

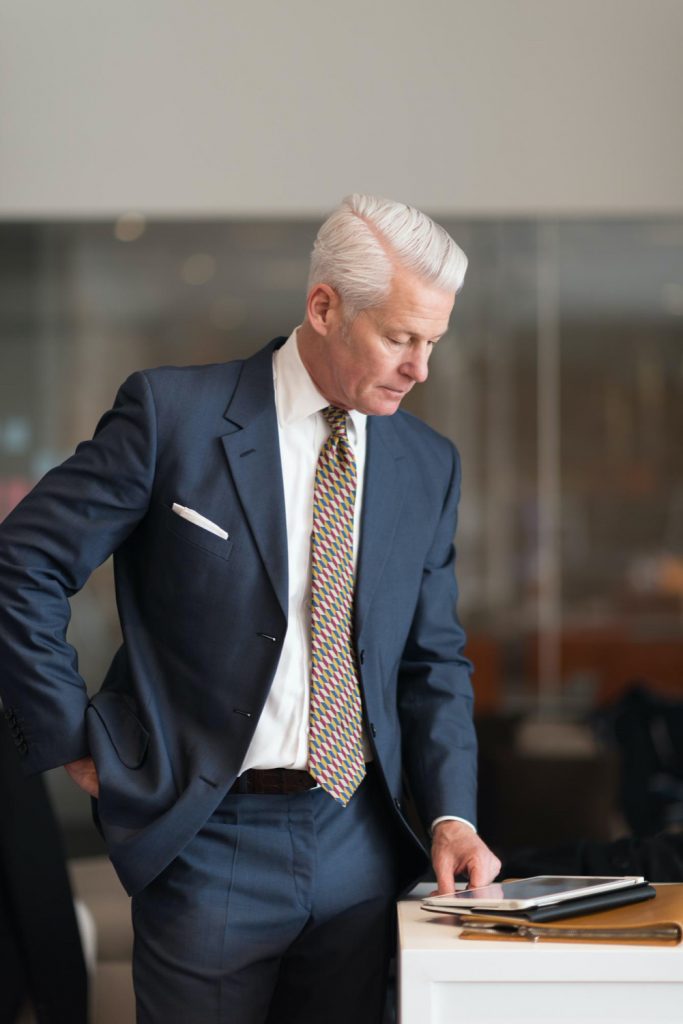

Generally considered the market leader over the past five years, Tesla has a market cap of over 909Bn as of Apr 29, 2022. The company exhibits sustained growth, delivering 310,048 cars in the first quarter of 2022, a 68% increase year-over-year. Its total revenues increased YoY by 81% to 18.76 Bn, driven in part by increased sales and an increase in average sales prices[viii]. While Tesla’s pricing is higher than competitors’, Tesla boasts of technological innovation – Autopilot, driverless assist and Full Self-Driving (FSD) capabilities.

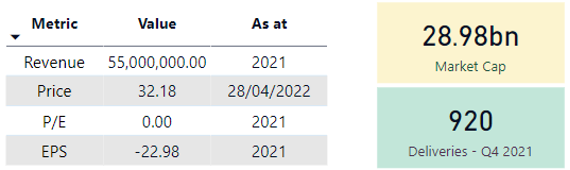

Recent volatility in Tesla stock is related to Musk’s US$44Bn Twitter deal. It was little impacted by Honda and GM’s announcement to produce more affordable EVs in five years. In fact, the stock reacted modestly, dropping by 4.7% on announcement date. It recovered soon afterwards but has fallen by as much as 12.18% in a single day since the Twitter deal came online. Month-to-date the stock has fallen just over 19%.

[vii] All company descriptions and fund objectives extracted from Refinitiv Eikons

[viii] https://tesla-cdn.thron.com/static/IOSHZZ_TSLA_Q1_2022_Update_G9MOZE.pdf?xseo=&response-content-disposition=inline%3Bfilename%3D%22TSLA-Q1-2022-Update.pdf%22