INSIGHTS

Investing: What you need to know & why it’s never too late!

A Firstline Securities Limited Blog by: Damien Gill

Investment Defined

An investment is the current commitment of dollars for a period of time in order to derive future payments that will compensate the investor for (1) the time the funds are committed (2) the expected rate of inflation during the period and (3) the uncertainty of future payments. Investing is important, and we here at Firstline are committed to seeing you achieve both your short – and long-term financial goal.

What we need to know before we start investing

Before embarking upon an investment programme, an investor must make sure that they have satisfied more pertinent needs. After all, no investment plan should begin until a potential investor has adequate income to cover living expenses while also holding a safety net.

So, lets cover the basics:

Insurance – life insurance should be a basic requirement for any financial plan. It protects our loved ones against financial hardship should (dare I say it) death occur. The death benefit can help cover medical expenses, funeral costs and retire debt. So, the first step must always be to acquire adequate life insurance coverage.

Insurance can also be a means to long term goals such as retirement. Upon retirement, you can receive the cash, or surrender the value of the policy to supplement your retirement lifestyle or estate planning purposes.

Insurance coverage also provides protection against uncertainties. Policies such as health, disability, automobile and home insurance provide help to pay medical bills, and protection against damages to cars and residence.

Cash Reserves – Job losses, emergencies, you name it. Life can be unexpected, and it is important to have cash reserves to help during these occasions. In addition to providing a safety net, having a cash buffer also reduces the likelihood of being forced to sell investments in the face of unexpected expenses.

Experts recommend a cash reserve of roughly six (6) months’ living expenses. Despite the term cash reserves, don’t keep these funds in cash. Instead these funds should be in investments that can easily be converted to cash without any real loss in value.

What’s Next:

Assuming the above has been met, an individual can now consider a serious investment programme. Below we discuss the various phases in the investment lifecycle. Although all investors’ needs and preferences are different, these are considered the general traits.

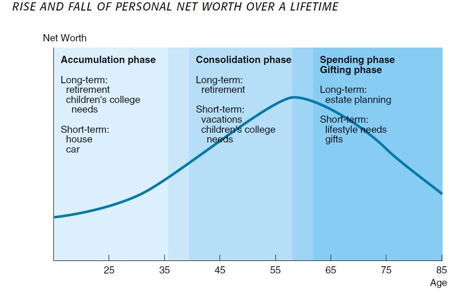

The Investment Cycle

The Investment Cycle

- Accumulation Phase – early to middle years of working career

- Consolidation Phase – past midpoint of careers. Earning exceeds expenses

- Spending/ Gifting Phase – begins after retirement

Accumulation Phase

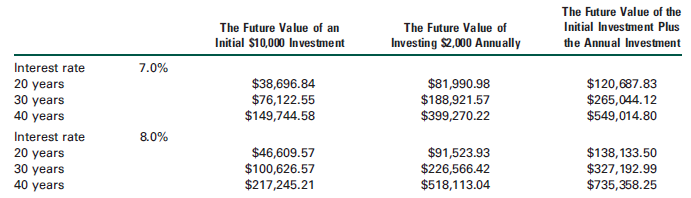

These are individuals in the early to middle years of their working career. Categorised by typically low net worth and debt in the form of University or car loans. Emphasis is placed on investing early. We have talked extensively on the benefit of compounding interest and the power of long-term investing. Below is a clear example of why.

Consolidation Phase

Typically, past the mid-point of the career where most debts have been cleared and earnings exceed expenses. The excess can be used to provide for future retirement or estate planning needs. Investment horizon is still long (20-30 years) so moderately risky investments are attractive.

Spending/Gifting Phase

This begins when individuals retire, and living expenses are covered by pension plans and prior investments. As earnings potential end, capital preservation becomes paramount. This phase of the lifecycle requires a change in mentality. Throughout our working lives we are encouraged to save but at this time spending is encouraged.

In addition, it is at this stage the investor may have excess assets and income to cover current and future expenses. If this is the case, these excess assets can be used to financially assist friends, family or charity.

Why it’s never too late

Despite which phase you ought to fall into, don’t forget it’s never too late to invest. Statistics suggest less than 10% of people are sure they have enough to live comfortably after they retire. Those numbers are dim and back up my belief that very few people actually think about long term planning and retirement. Consider these facts:

Life doesn’t stop at 65 – There is no hard and fast rule that says we must retire at 65. There are many ways to generate income later into our lives without the strain of 40 hr work weeks. Use those built up skills for consultancy work or consider becoming a part time teacher or professor.

Age isn’t always a bad thing – age has its advantages. In the later stages of your career, your income earning potential is much higher, therefore, savings potential is also higher. Save that extra cash and play the catch-up game.

Compound interest still works – Compound interest will always work in your favour the longer you invest, that is the undeniable. However, that doesn’t mean it can’t work for you over 10 -15 years or even as short as 5 years.

Conclusion

So, to sum it all up, ensure you have adequate insurance coverage and a cash reserve before you begin investing. Understand what phase of the investment lifecycle you are at and make the necessary lifestyle adjustments according to your earnings. And last but certainly not least, don’t forget it’s never too late to invest. We at Firstline are versed in the areas of Corporate Finance, Wealth Management, Bond Trading and Advisory Services. We were born to create wealth for the people. Give us a call @ 628-1175 and start your retirement planning. We will make sure you are one of the less than 10% of people who can lay claim to having enough money to live comfortably at retirement. Money doesn’t grow on trees, but it will at Firstline.