Investors earned 11,931.82% in 10 years!

That’s what investors who purchased Tesla one year after it first was listed on a public exchange earned. The stock was listed on June 29th 2010 and earned and impressive 66.42% after one year. Investors who took a short-term view would have lost out on an additional 11,931.82% or $3,375.51 of upside for every 1 share purchased.

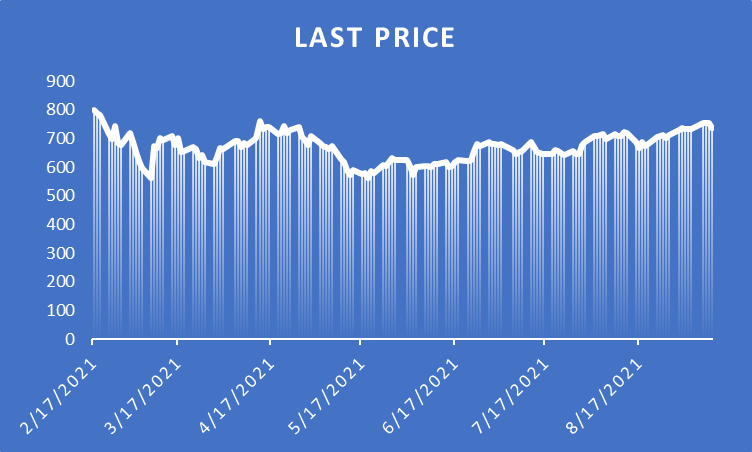

Breaking the first year up a bit, early investors who got in on June 29 2010 would have purchased at a minimum price of $19. Seven days later they were sitting on a 21.16% loss as the share price dropped to $14.98. One year later the stock was up over 60%

The Tesla example has several potential outcomes, first, for an investor or speculator who decided to purchase the stock, either because it was an IPO or they heard about the hype around this new electronic car company and its enigmatic CEO. They may have gotten scared off after 7 days siting on over 20% in losses and decided to cut their losses and sell.

Then for those who purchased on July 7th or at IPO who were up over 68% in one year by June 29th 2011, three times more than the overall market. For almost any investor this would have been much more than their initial projections and expectations, hence it would seem perfectly rational to sell and “take profits”.

For investors who had a long-term horizon and maintained their investment they would have benefited from the 11,000% plus surge the stock went on to achieve after its first year on as a listed company.

While Tesla was a “once in a lifetime” opportunity (or maybe lightning could strike twice in our lifetimes!), investors who purchased the stock with a clear expectation of their investment horizon and return expectations would have either remained invested after reviewing their position during the investment term or exited upon the achievement of their objectives without many regrets of the opportunity missed.

1 Comment

Informative and educational. thanks.